Prime-CC.com Review Explores Fees, Usability, and Customer Feedback

In this Prime-CC.com review, we delve into the intricacies of one of the notable online brokerage platforms available to investors. This platform has garnered attention for its diverse range of features, competitive fee structures, and user-friendly interface. As investors increasingly seek efficient and accessible platforms to manage their portfolios, this platform emerges as a contender worth exploring.

Prime-CC.com review highlights key aspects such as fees, usability, and customer feedback, providing readers with a comprehensive overview of what the platform offers. With a focus on transparency and accessibility, the brand aims to cater to both novice and experienced investors alike, ensuring a seamless experience for users navigating the complexities of online trading.

Prime-CC, the brand behind this platform, has positioned itself as a reliable option in the realm of online brokerage services. With a commitment to delivering quality services and fostering a positive user experience, this brand continues to attract attention within the investment community.

As we delve deeper into this review, we aim to provide insights that can help individuals make informed decisions about whether this platform aligns with their investment goals and preferences.

Fee Structure Breakdown: Understanding Pricing Models

Source: freepik.com

Prime-CC.com meticulously constructs its fee structure to provide investors with a transparent and predictable framework for their transactions. Within this structure, investors encounter various fees, including commissions, account maintenance charges, and transactional costs.

Noteworthy is this platform’s competitive commission rates, which often undercut those of traditional brokerages, positioning it as an enticing option for those seeking cost-efficient solutions.

Moreover, this brand’s fee tiers, contingent upon factors such as account type and trading volume, offer a flexible approach to accommodate diverse investment strategies. This flexibility empowers investors to select fee structures aligned with their financial objectives and trading habits, thereby enhancing their overall experience on the platform.

Regular reviews and adjustments to the fee structure further underscore this brand’s commitment to remaining competitive in the market and continuously delivering value to its users.

Navigating the Interface: User Experience Evaluation

A cornerstone of this platform’s ethos is its unwavering commitment to providing an exceptional user experience, evident in the intuitive and user-friendly interface it offers. Simplifying the investing process for users of all experience levels, the platform’s interface embodies principles of simplicity and clarity.

From the seamless setup of accounts to the efficient execution of trades, this brand’s design facilitates straightforward navigation. Whether accessed through a desktop browser or a mobile device, the platform ensures a seamless experience, guaranteeing that essential features and information are readily accessible to users at all times.

By prioritizing user-friendly design, the brand seeks to streamline the investing journey and empower investors to make well-informed decisions with confidence, thereby fostering a positive and rewarding user experience that sets it apart in the online brokerage landscape.

Insights from Investors: Unveiling Customer Feedback

Source: freepik.com

Central to Prime-CC.com’s continuous improvement efforts is the invaluable feedback provided by its users, offering profound insights into the platform’s strengths and areas for enhancement.

Positive feedback often underscores aspects such as ease of use, reliability, and responsive customer support, reaffirming this platform’s dedication to delivering a top-tier service experience. Conversely, constructive criticism catalyzes improvement, pinpointing specific feature requests or areas where enhancements could be made to better meet the needs of users.

This brand values this feedback immensely and actively incorporates it into its ongoing development efforts, ensuring that the platform evolves in alignment with user expectations and preferences. By maintaining an open dialogue with its user base and leveraging their insights, this brand remains committed to delivering a best-in-class online brokerage experience that exceeds the expectations of its users.

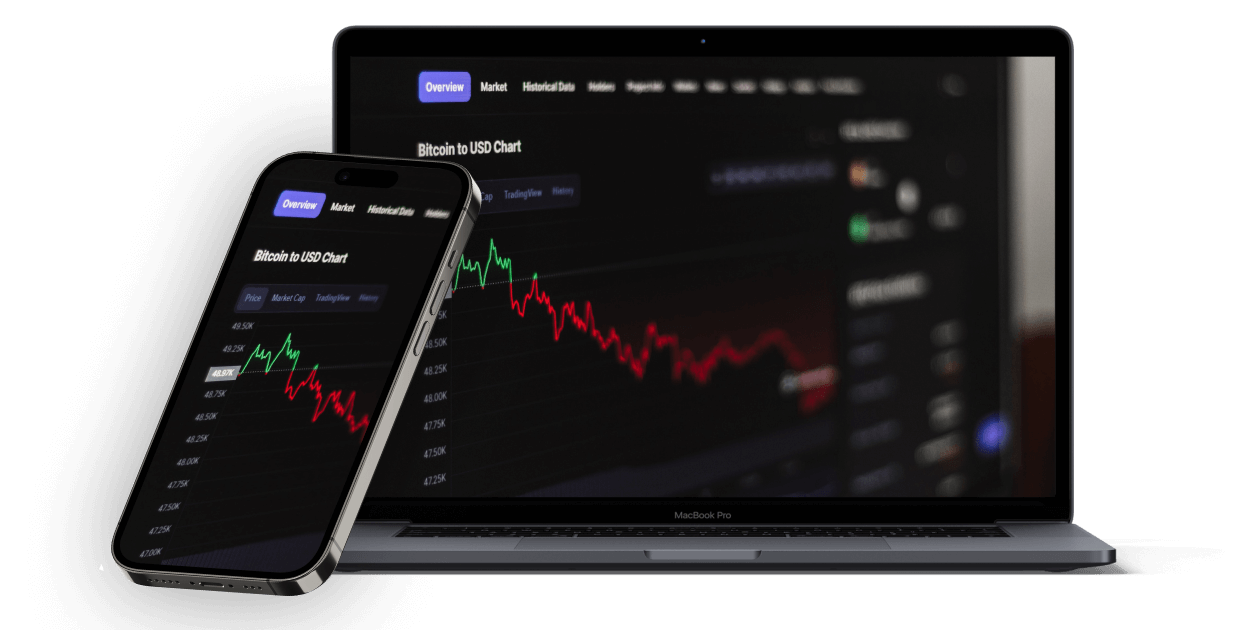

Tools and Resources: Empowering Investors

This platform offers a comprehensive suite of tools and resources designed to empower investors and enhance their overall investing experience. From cutting-edge research and analysis tools to educational resources and market insights, this brand provides investors with the information and tools they need to make well-informed decisions and navigate the markets with confidence.

Whether investors are looking to conduct in-depth research, analyze market trends, or access educational materials to expand their knowledge, the platform offers a diverse array of resources to support their needs.

By providing access to valuable tools and resources, the brand aims to equip investors with the tools they need to succeed in their investment endeavors, empowering them to take control of their financial futures and achieve their long-term goals.

Through forums, social media channels, and networking events, users have the opportunity to connect with like-minded individuals, share ideas, and learn from one another’s experiences. By fostering an environment of collaboration and learning, this brand aims to not only empower investors but also foster a sense of camaraderie and mutual support among its user base.

Comparing Costs: Fee Analysis in Context

Source: freepik.com

When considering an online brokerage platform, understanding the associated costs is paramount. In this section, we conduct a comprehensive fee analysis of this platform in comparison to industry standards, providing investors with valuable insights into the cost-effectiveness of the platform.

This brand’s fee structure is designed to offer transparency and competitive pricing, with a range of fees including commissions, account maintenance charges, and transactional costs. The platform’s competitive commission rates often undercut those of traditional brokerages, making it an attractive option for cost-conscious investors.

Additionally, this platform’s fee tiers, which vary based on account type and trading volume, provide flexibility to accommodate different investment strategies.

To provide context for this brand’s fees, we compare them to industry standards and benchmark them against other leading online brokerage platforms. This comparative analysis allows investors to assess the cost-effectiveness of this brand relative to its competitors and determine whether it aligns with their financial goals and preferences.

Conclusion

In wrapping up this exploration of this brand, it’s evident that the platform stands out in several key areas. Through its transparent fee structure, Prime-CC.com offers investors clarity and predictability, fostering trust and confidence in its services.

The user experience provided by the platform’s intuitive interface ensures that investors of all levels can navigate the platform with ease, while the abundance of tools and resources empowers them to make informed decisions about their investments.

By incorporating valuable insights from user feedback, this brand demonstrates its commitment to continuous improvement and responsiveness to user needs. This customer-centric approach not only enhances the platform’s offerings but also fosters a sense of community among its users.

In essence, this Prime-CC.com review has underscored the platform’s strengths and its commitment to providing value to its users. As investors navigate their financial journeys, this platform remains a noteworthy option worth considering for its transparency, usability, and cost-effectiveness.

Important Notice: This article has an informational focus and does not advocate for or against the company. The writer is uninvolved in the company’s actions during your transactions. The data could be outdated or imprecise; hence, all financial decisions should be made carefully. We provide no warranties and are not responsible for any financial outcomes.