Comparing Traditional and Mobile Card Payment Solutions: Tips for Choosing

In today’s fast-changing world of selling and buying, companies are always on the lookout for payment methods that are easy to use, safe, and make their customers happy. As tech gets better, it’s getting harder to tell the difference between classic card payment methods and the new, on-the-go ones, giving businesses lots of options. This piece dives into the details of both classic and on-the-go card payments, giving you the full scoop to help businesses choose what’s best for them based on what they need and what their customers like.

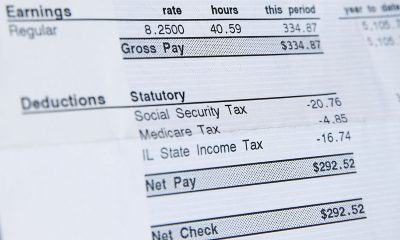

How Card Payments Have Changed

Source: bpcbt.com

The history of card payments is pretty amazing, starting from the old-school manual card imprinters to today’s fancy digital setups. Classic methods like point-of-sale (POS) machines hooked up to phone lines or the internet have been at the heart of shop sales for ages. These gadgets make sure payments go through by checking the magnetic stripe or chip on cards, keeping transactions safe over trusted networks.

On the flip side, on-the-go card payments are the latest thing in making payments. Thanks to everyone having smartphones and tablets, these methods bring a lot of freedom, letting sellers accept payments no matter where they are. On-the-go payment tech ranges from Near Field Communication (NFC) for touchless payments to little gadgets that make a Mobile card machine from your smartphone.

Getting to Know Classic Card Payments

Classic card payments are known for being reliable, widely accepted, and following strict security rules. These setups are usually fixed in place, needing a set setup to work. They’re perfect for physical stores where customers pay at set checkouts. Classic setups are great at handling lots of sales quickly and accurately, which is why they’re common in stores.

Safety is a big deal with classic card payment setups. They use different kinds of tech to keep information safe and meet the Payment Card Industry Data Security Standard (PCI DSS), making sure customer info is protected during a sale. Plus, classic systems often work together with stock and accounting programs, giving businesses a complete view of their operations.

The Growth of On-the-Go Card Payments

The arrival of on-the-go card payments has changed the game, bringing a level of freedom and reach that was hard to imagine before. These systems fit the changing needs of modern businesses, from temporary setups and food trucks to service providers working outside a traditional space. On-the-go payments turn smartphones and tablets into flexible cash registers, needing just a little hardware like a card reader or a contactless payment gadget.

A big plus of on-the-go payment systems is how they make transactions smooth anywhere. This mobility lets businesses boost how they connect with customers by making the checkout process easy and quick. Also, on-the-go systems often have easy-to-use designs and powerful features, including stock management, sales tracking, and customer insights, all from a mobile device.

Thinking About Security

When looking at classic versus on-the-go card payments, safety is a big deal for both businesses and their customers. Classic systems have a solid reputation for being safe, thanks to strict standards and a well-set infrastructure. On-the-go systems are also built to be secure, but it’s important for businesses to keep the devices used for payments safe from threats.

Both classic and on-the-go systems use encryption and tokenization to keep sale info safe. But, businesses need to make sure mobile devices are safe, with up-to-date software and limited access to only those who need it. Also, it’s key to pick on-the-go payment providers that stick to PCI DSS and have strong safety measures to avoid data leaks.

Thinking About Costs

The cost setups for classic and on-the-go card payments are quite different and can affect a business’s decision. Classic POS systems usually have higher starting costs, including buying hardware and setup fees. They also have ongoing costs like monthly service fees and charges per transaction, which can change based on the provider and how many sales are made.

On the other hand, on-the-go payment systems often start at a lower cost, with many providers offering free or cheap card readers and charging fees per transaction. This pay-as-you-go approach can be really appealing to small businesses and startups watching their budgets. However, it’s important for businesses to look at the total cost over time, thinking about things like transaction fees, monthly charges, and any extra hardware or software they might need.

Fitting Together and Growing

As businesses grow and change, how well a payment system fits with other tools and can grow with the business is more and more important. Classic card payment systems are part of a well-established setup, making it easy to work with stock, accounting, and customer relationship management (CRM) software. This fitting together makes business operations smooth and gives valuable insights into what customers are doing and buying trends.

On-the-go card payment systems are built to be flexible, offering APIs and plugins to work with different business apps. These systems can easily grow to fit a business, from adding more devices for extra checkouts to offering more ways to pay. Businesses need to check how well payment systems fit with what they already have and their plans for growth, making sure the chosen system can keep up with their changing needs.

Customer Experience and Connection

In today’s digital shopping world, how customers feel is everything. Classic card payment systems give a familiar and reliable feel, especially for customers used to traditional shopping settings. These systems make transactions straightforward, with options for extra services like loyalty programs and gift card setups.

On-the-go card payment systems shine in offering a modern, smooth checkout experience. Being able to make payments anywhere in a store or outside a traditional shopping place can make customers happier, cutting down wait times and boosting overall satisfaction. Plus, on-the-go systems often come with features that help with personal touches, like customized receipts, loyalty perks, and special offers based on what customers have bought before.

Picking the Best Option

Source: blog.clover.com

Choosing between classic and on-the-go card payment systems means thinking carefully about what a business needs, who their customers are, and what they plan for the future. For well-set stores with lots of sales and a need to work well with what they already have, classic systems might be the best because of their stability and features. But, for businesses looking for freedom, the ability to move around, and new ways to connect with customers, on-the-go payment systems might be the perfect fit.

In making this choice, businesses should think about:

- What they do and where sales usually happen

- How often and how many sales they make

- What kind of safety they need and rules they have to follow

- How much they can spend and what’s the most cost-effective

- How well the system fits with other business tools

- Plans for getting bigger and handling more

- How important making customers happy and connecting with them is

In the end, choosing between classic and on-the-go card payment systems doesn’t have to be an either/or. Many businesses find it useful to use a mix, keeping classic systems for in-store sales and on-the-go options for sales outside or as extra checkout choices. This flexibility lets businesses meet the different needs and likes of customers and keep up with a market that’s always changing.