How to Deal With The Complications of Filing an Insurance Claim in 2024

For millions of people worldwide, an insurance policy is one of the most important things that they could obtain. After all, the entire purpose of it is to provide coverage for a wide range of accidents, damages, and situations, however, what happens when you run into complications when filing or when you get a rejection?

No matter if your claim was denied or if you aren’t satisfied with the offer you received, you might be wondering – how can I deal with these complications? Fortunately for all individuals that found themselves in this situation, the list below could help you. Let’s take a look at some things that you could do:

Img source: pexels.com

-

Firstly, Try Notifying Your Insurance Organization About The Problem

Before you try anything else from this list, you should first try notifying and talking with your insurance firm about the problem you have. However, if the company representative cannot solve your issue, you should ask them for the phone number and name of the head of the claims department. Depending on the organization, it may also have a consumer complaint department, meaning that they might provide you with the assistance you require.

-

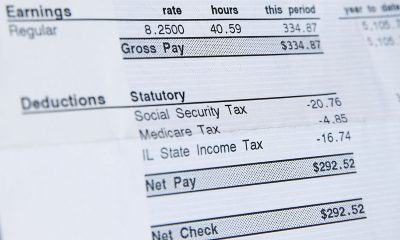

You Must Have The Required Documents

No matter what situation you found yourself in, you must ensure that you have all the required documents. Why do you require these? Well, you’ll need to send copies of the original papers, as well as a letter where you’ll explain why you’re troubled with the offer, or why it has been denied. All of these things will back up the arguments you make and don’t forget, you need to also write down your contact information (name, surname, telephone number, email, address) and more importantly your claim number.

-

Review Your Automobile Insurance Policy

If you don’t know anything about insurance policies or if you have never filed such a claim before, you’ll have to take a look at the policy you have. Besides this, there are companies such as www.tachoirauto.com that can help you start the entire process, hence, if you don’t know where you should begin, you could opt for such services. Nonetheless, you’ll still want to review the plan you got, especially since this will help you determine what your next step should be.

Img source: pexels.com

-

Your State’s Department May Assist You

You may want to choose to contact your state’s insurance department, and if so, you should know that you’ll need to explain, in detail, what complications you came across. Now, keep in mind that they might not be able to solve every single complaint made to them, but, they will collect all the information you provide to them. This will help you later on, especially if they choose to review your case individually.

-

Contact an Independent Mediator

If you have tried some of the aforementioned things and nothing works, you might want to contact an independent mediator. Why should you do this? Well, it’s quite simple – a mediator that is skilled, knowledgeable, and experienced in insurance claims and policies will tell you whether or not there is something you could do with your claim and they’ll also be able to tell you if the offered settlement is fair. The insurance organization may provide you with one, but, you could also get your own arbitrator.

-

Check if All The Information is Correct

Although you may not realize it, your claim might have been denied before you failed to provide the needed information or you may have submitted the wrong one. For instance, if you gave the wrong information on how a particular vehicle got destroyed, it can easily influence your claim. So, gather all the documents you sent, review them, and if you find out that you made a mistake, correct it and resend it.

Img source: pexels.com

-

You May Have Been Late

Every single state has precise guidelines and regulations on when you can submit your claim. For instance, you cannot submit a claim two years after the accident occurred, which is why you must connect with your local government and ask about the deadlines you have. Besides this, you can speak to your lawyer, especially since they’ll know exactly what you must do in order to meet the deadline and submit your claim. Keep in mind, if you were late, there is really nothing that you could do.

-

Lack of Due Care is Also a Thing

Do you know what lack of due care is? Well, if you choose to leave any of your assets (especially the expensive ones) on display in your vehicle or if you, for example, leave your laptop on the front seat, you won’t be covered by your policy. Hence, if your claim was rejected because of this, there is really nothing that you could do to get covered for the items you have lost. This is why you must always be careful when leaving your car.

-

Talk With Your Lawyer

Last on our list, but not least important is talking to your lawyer or one that specializes in insurance claims. You should know that each state will offer a list of attorneys that you could opt for, and this will help you with ensuring that they’re qualified. Depending on your case, they might work on a contingency plan or an hourly rate, hence, you should ensure that you’re comfortable with the payment requirements. Remember, your legal representative must have your consent before settling for a specific amount. Keep in mind, you must ensure that the lawyer is skilled and experienced, which is especially true if the damages are extensive.

Img source: pexels.com

Conclusion

There is a wide range of reasons why some complications might have occurred when you tried to file your insurance claim. Depending on your situation, as well as the policy you have, you can use the list above to determine how you’ll need to deal with the problems and what you’ll have to do.

Hence, now that you’re aware of what you might need to do, you shouldn’t lose any more time – especially since there might be deadlines for resubmitting your claim. Instead, determine what you could do, and then ensure that you follow all the steps in the process.