Strategies to Reduce Your Homeowners Insurance Costs: 2024 Guide

In 2024, managing household expenses is more critical than ever, and homeowners insurance is a significant part of that. While it’s essential for protecting your home from unforeseen events, it doesn’t mean you should pay more than necessary. This comprehensive guide explores effective strategies to reduce your homeowner’s insurance costs without compromising on coverage.

Shop Around and Compare Prices

Start by obtaining quotes from multiple insurance companies. Use online comparison tools or consult with an independent insurance agent who can provide a variety of options. Ensure that each quote is for the same level of coverage so you’re comparing apples to apples.

While the price is essential, don’t overlook the importance of customer service and the insurer’s financial stability, especially when considering providers like Erie Mutual Welland Home Insurance. Check reviews and ratings on consumer websites and financial rating agencies to gauge their reputation. A lower price might not be worth it if it comes at the expense of responsive customer service or financial reliability in paying claims. With Erie Mutual Welland Home Insurance, prioritizing both affordability and quality service ensures peace of mind knowing you’re protected by a reputable insurer with a track record of reliability and customer satisfaction.

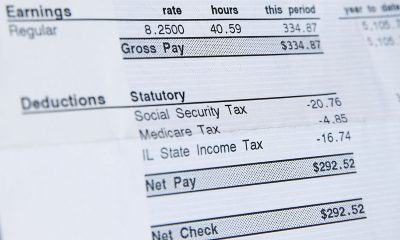

Increase Your Deductible

Source: marketwatch.com

Increasing your deductible is a straightforward yet impactful method to lower your homeowner’s insurance premiums. By opting for a higher deductible, you’re essentially taking on more financial responsibility in the event of a claim. Insurance companies typically reward this willingness to shoulder a greater portion of the risk by offering reduced premiums. It’s crucial, however, to strike a balance between potential savings and your ability to cover the higher deductible out-of-pocket. Assess your financial situation carefully before making any adjustments. While a higher deductible can lead to significant savings on your premiums, ensure you have sufficient savings set aside to cover the deductible if needed. By weighing the potential savings against the increased financial risk, you can make an informed decision that aligns with your budget and risk tolerance.

Make Your Home More Disaster-Resistant

Consider updates that reduce your home’s vulnerability, such as storm shutters, reinforced roofing, or modernized heating and electrical systems. These improvements can prevent potential claims and lead to lower premiums.

Seeking out insurance discounts is an effective strategy to reduce your homeowner’s insurance costs without sacrificing coverage. Many insurance companies offer a variety of discounts, yet policyholders often overlook them. These can include reductions for having a security system, and smoke detectors, or for bundling multiple policies, like auto and home insurance. There may also be discounts for homes made more resilient to natural disasters, for maintaining a claim-free record, or for being a long-term customer. It’s essential to regularly review your policy and ask your insurer about available discounts. Proactively providing updates on home improvements and security enhancements can also unlock potential savings. Staying informed and asking the right questions can lead to significant annual savings on your homeowner’s insurance.

Source: linkedin.com

Conclusion

Homeowners insurance is a vital part of protecting your investment in your home. However, it doesn’t have to break the bank. By shopping around, increasing your deductible, and making your home more disaster-resistant, you can significantly reduce your insurance costs. Remember, the goal is to strike a balance between adequate coverage and affordable premiums. Armed with these strategies, you’re well on your way to achieving that balance in 2024.