5 Signs Your Business Needs a Professional Tax Consultant

Tax season is here, and if your business isn’t prepared, you could be in for a lot of headaches. Don’t let your business suffer from not knowing what taxes to expect – get in touch with a professional tax consultant and have them take a look at your situation.

Here are five signs that your business may need professional help with its taxes:

1. You’re unsure of your tax obligations

A tax consultant can walk you through all of your options and make sure you’re taking the right steps to minimize your tax liability.

2. You’re struggling to keep up with changes in the tax code

The tax code is always changing, and if you’re not up to date on the latest changes, you could be at risk of paying more than necessary. Make sure to have a professional review your filings every year so that you’re taking the most advantage of current laws.

3. You’ve been receiving wrong tax advice from your employees or friends

A professional will have a solid understanding of all the latest tax laws and can give you sound advice based on that knowledge.

Source: kalikonto.com

4. You’re facing significant doubts about your tax situation

If you’re feeling doubts about your tax situation, it’s time to get in touch with a professional. They can help you to clear up any confusion and set you on the path to a successful tax season.

5. Your business is struggling financially

Make sure to have a professional review your finances and provide you with sound tax advice that can help you keep your business afloat.

You’re Not Filing Your Taxes on Your Own

If you’re like most business owners, you probably don’t have the time or resources to file your taxes on your own. That’s where a professional tax consultant comes in. A consultant can help you with everything from preparing your tax returns to filing them correctly.

When you work with a consultant, you’ll get access to their years of experience and expertise. They’ll be able to help you understand all the different tax laws and regulations that apply to your business. This will help you stay compliant with the law and avoid costly penalties.

Finally, working with a professional tax consultant is a cost-effective way to get the best possible financial results for your business.

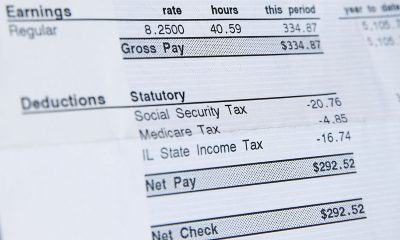

You’re Getting Errors in Your Returns

Source: patriotsoftware.com

If you’re noticing errors on your business tax returns, it may be time to hire a professional tax consultant. Many businesses get errors in their returns because they don’t have the expertise or resources to handle their own taxes.

Professionals, such as Manchester tax consultants, are trained in all aspects of business taxation. They can help you figure out which deductions and credits you’re eligible for, and can guide you through the complicated filing process. They can also help you understand the implications of various tax laws changes that have recently gone into effect.

Professional tax consultants have the training and experience to help you navigate the complex business taxation system.

You’re Not Sure Where to Start

One of the most common mistakes business owners make is not hiring a professional tax consultant. This is because it can be difficult to determine when your business needs help with taxes.

If you’re not sure if your business needs help with taxes, start by looking at your annual income and expenses. If you’re spending more money than you’re making, then your business probably needs help with taxes.

You can also look at your company’s financial statements to see if there are any red flags. For example, if your company is losing money year after year, that may be a sign that you need to hire a professional tax consultant.

Finally, don’t hesitate to speak with other businesses in your area. Many of them will have used a professional tax consultant in the past and can recommend one for you.

You’re Not Able to Answer Tax Questions

Source: paro.ai

If you’re not able to answer tax questions yourself, it’s time to call in a professional. A business that doesn’t have the expertise to handle its own taxes can quickly find itself in trouble.

There are a few signs that your business needs a professional tax consultant. If you don’t have the answers to basic questions like where your profits are going, or how much money you owe in taxes, it’s time to seek outside help.

In addition, if you notice any major changes in your finances or business that don’t seem justified, it might be time to get help from a tax consultant. This includes any unexpected increases or decreases in income or new investments that seem too good to be true.

If you find yourself struggling to keep up with tax filings and paperwork, it might be time to consider hiring a professional. A good tax consultant will be able to guide you through the process and help you stay on top of your taxes.

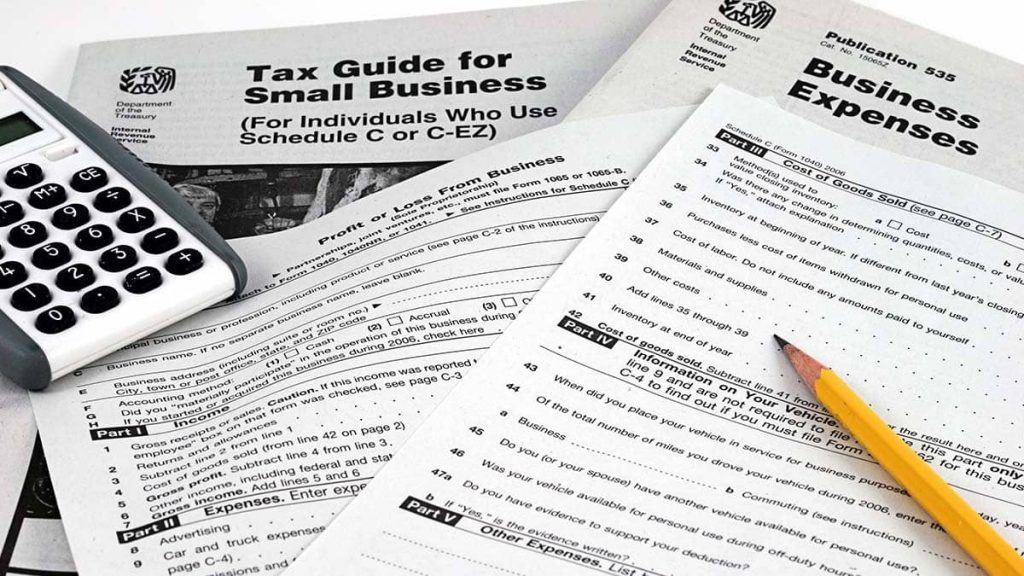

You Don’t Have the Time or Resources to Do it Yourself

If you’re like most small business owners, you probably don’t have the time or resources to do your own taxes. That’s why it’s important to hire a professional tax consultant. A tax consultant can help you with everything from preparing your taxes to helping you dispute your taxes if you feel that you’re being wronged.

One of the biggest benefits of hiring a professional tax consultant is that they have years of experience working with small business owners. They will know what questions to ask and how to get the most out of your return. Plus, they’ll be able to provide you with advice on how to save money on your taxes.

If you’re considering hiring a professional tax consultant, be sure to ask for references. You don’t want to end up with someone who isn’t qualified or who will charge an excessive fee. Make sure that you choose a consultant who is reputable and has a good track record of helping businesses save money on their taxes.

Source: businessnewsdaily.com

Conclusion

It’s no secret that taxes can be quite a headache for small businesses. Whether you’re self-employed or run a company with employees, preparing your own taxes can be difficult and time-consuming. That’s where a professional tax consultant comes in — they can help take the burden off of your shoulders and make sure you’re paying the right amount of tax each year. Not only that, but they can also provide advice on other business-related issues, such as buying or selling a business, setting up corporate accounts, and more. If you’re feeling overwhelmed by all the paperwork involved in running your business, it might be time to call in the pros.